Introduction

One of the main tenets of investing is diversification. I have spoken of it many times in these letters. Most managers build their portfolios with this concept in mind and over time diversification achieves steady returns with a balanced risk profile. The past quarter, year-to-date and current rally are exceptions. The US stock market has done very well while international stocks (except Japan), emerging market securities, bonds, preferred stock, commodities and gold all have underperformed. Eventually this dynamic will shift. Therefore, it is important to remain diversified in an effort to stabilize returns over time and reduce overall portfolio risk.

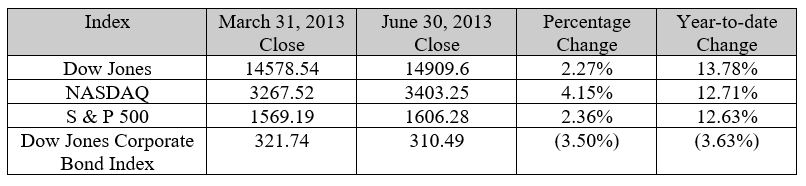

The Markets

April was a somewhat volatile month that finished on a strong note. The first part of the month was a piece of a record setting 14 consecutive up/down days (meaning no two up or down days in a row). The terrorist attack in Boston also contributed to the instability, in fact on that same day gold had its worst down day ever.

May took the strong finish in April and ran with it. Starting with a better than expected job report, stocks took off and were further pushed by the best gain in housing prices in over seven years. However, we then had the first Fed statement implying that the time for Quantitative Easing could come to an end sooner than expected. Stocks and bonds began a retreat.

June saw this retreat gain strength. From intraday high in May to intraday low in June the S&P 500 pulled back about 7.5%. Then we had the Fed reverse course and say that they would only slow or stop QE if the economy was strong enough—if the economy was too weak they might actually buy more. This caused a reversal that pushed stocks up (and continues to do so) as the month ended.

The Fed

Perhaps nothing drove the market this quarter like the statements from various Federal Reserve Board officials. During late May and early June it seemed like almost every day some Fed President of some City was explaining why he thought the Fed was getting closer to ending QE or why she thought the Fed would increase purchases if the economy continued to perform below expectations. There were rumors of the Fed lowering the target unemployment rate to 5.5% before raising interest rates; there was talk about ending QE by the end of this year, instead of the end of next year. There was even speculation that the Fed was really purposely inserting some uncertainty into the markets to calm down the falling rates. At the low point in May, the 10 year US Treasury bond was yielding about 1.6%, a month later it was 2.7% (just a bit above where it is at the time of this writing). High yield stocks yielded about 5% at one point, the lowest ever, which was astounding considering they have never been below 6% before January and historically were rarely below 7%.

The bottom line is that it seemed the Fed was saying they would act based on the economic data; meaning that if the economy continued to sputter they would keep QE around longer, if the economy strengthened, they would decrease the amount of bond purchases. This created a time where good news was bad news and bad news was good news. However, once Chairman Bernanke clarified that there was no real timetable for slowing and that the Fed would look to expand the buying if the economy weakened then a situation was created where bad news was good news and good news was good news (hence the big rally during the month of July).

The Diversification Problem

The US stock market was the place to be during the second quarter (as well as YTD—the YTD rally has been so smooth that it was all the way till June before stocks suffered their first three-day losing streak of the year—and then the next day was a big rally). An interesting thing about the Fed statements is that the stock market fell and then rallied as the Fed clarified itself, but the bond market fell and has more or less stayed flat. So bonds, and really any interest rate sensitive investment including utility and telecom stocks, suffered but did not rebound like the general stock market. The problems in the rest of the world caused international stocks and especially emerging market stocks to do poorly for the entire time. Commodities and especially gold also performed poorly.

The fears of a slowdown in China kept emerging markets muted and hurt commodity based economies; and the fears of a European depression kept most international stocks from rising as much as their US counterparts. Southern Europe remains basically in a depression, France is in its third recession in four years, the UK narrowly avoided slipping into another recession (although inflation concerns have cropped up halting any further stimulus for the time being), and Northern Europe continues to struggle.

The one place that did work outside the US was Japan as stocks there received a massive boost due to the BOJ stating they would do whatever was necessary to achieve the 2% price stability target within two years. This was a much stronger statement than expected. However, it is noted Japanese stocks corrected with the rest of global investments from late May to late June, but have not reached the May highs, like the US market has, so they still have not done as well.

That is not to say that the US markets don’t deserve their status as the best investment during this timeframe. The US economy is clearly the best story around, at least in the developed world. The housing market has been doing very well. Prices advanced on a year-over-year basis for the third year in a row and the biggest jump in seven years; homebuilder sentiment was the highest in seven years; and new home sales hit a five-year high. Manufacturing data continues to show strength, despite a slight hiccup in May, the most recent data is the best in years. Housing, the stock market, manufacturing, and I think the energy resurgence, have all contributed to consumer confidence numbers that are very good. Simply stated, consumers feel pretty good about where we are.

With one big exception—the employment picture continues to experience a labored recovery. The most recent report was mediocre at best, while the unemployment rate for June was 7.4%, the lowest since December 2008, the actual jobs created disappointed, and the employment participation rate has not been this bad since the 1970s. Additionally, the GDP numbers continue to be soft. The final read on the 1Q13 was 1.1% (revised down from 1.8%); the first take on 2Q13 was 1.7%. The good news is that as long as wages stay stagnant it is unlikely inflation would start to rise to the point where the Fed needs to taper QE or raise interest rates. Currently, inflation remains under 2% with no signs of increasing for the time being.

The Energy Market

The continuing developments in the US energy production industry have the potential to alter significantly the long-term path of the global economy. I have been seeing more and more articles discussing the concerns of Saudi officials as to the effect of the US growth in energy production and the ramifications for the Saudi economy. The US passed Saudi Arabia in terms of fuel production (which takes refining into consideration, not just pure energy production) in November 2012 for the first time in ten years. At the current rate of expansion the US will be the world’s largest energy producer by 2020. North Dakota produced 40% more oil in February than it did one year previously. African OPEC members are suffering the most as the oil they produce is most similar to US shale production (US exports from Nigeria, Algeria and Angola were down 41% from 2011 to 2012 –the lowest in decades). The US and Canada are set to produce 21% more oil in 2018 than this year. US crude production is at 21-year highs, and to top it off, demand for oil is modestly decreasing (Faucon, Kent, and Hafidh, “US Oil Boom Divides OPEC” WSJ.com 5/27/13).

The link between the last two paragraphs is the US manufacturing revival is more about higher production, rising wages in China and cheaper energy (natural gas) than creating jobs. The factory of today is not a bunch of blue-collar workers on an assembly line; it is a bunch of robots and a few technicians. Today manufacturing jobs are more likely to be engineers and salesmen. That combined with a lack of hiring by small enterprises have been the main reasons the recovery has been so mediocre.

The Future

I will be the first to admit that I am befuddled by the actions of the US stock market the past year or so. Logically we should not be making new highs when the recovery has been so anemic. The Great Recession was the worst of the post war recession, but the best of historical global panics—meaning it was somewhere in-between. We had a much shallower bottom than the Great Depression but also a slower recovery. However it seems we are on the same path in terms of time insofar as how long it will take us to truly recover. As for stocks revenue numbers continue to disappoint (in the current quarter only about 55% of companies are beating their top-line numbers, below historical averages), yet companies continue to beat on the bottom line. It is great that companies are doing more with less, but this contributes to the high jobless rates. Record after record in stocks is not sustainable when economic results are so middling. However, the average length of the last ten expansions is 60 months; we are in month 49; so this could go on for a little while longer. Keep in mind the stock market will turn over before the economy does.

Globally central banks have made over 520 interest rate cuts in the past six years and put $33 trillion into the system via various stimuli. Over half of all government debt in existence yields less than 1% (Kopin Tan, Barron’s, 7/1/13). This mispriced capital and artificially low interest rates also cannot continue unchecked without dramatic consequences eventually. That is a fancy way of saying things like inflation, very low GDP growth rates and/or recessions are likely the longer the central banks of the world continue their hyper-easing policies.

Conclusion

To the extent investors’ portfolios are invested in US stocks, they have participated in the recent advance of the US stock market. However, to the extent those portfolios are invested elsewhere, they have struggled. In my opinion, the markets are not acting rationally at this point. Despite the overt problems in Europe, I think there is long-term value there. I also think that the emerging markets have more potential in the long-term than the developed markets. I continue to believe that the diversification model is the best model for investors.

I still prefer dividend paying stocks, master limited partnerships (MLPs), remain cautious on bonds, like the longer-term outlook of the emerging markets, and think holding some cash for future opportunities makes sense.