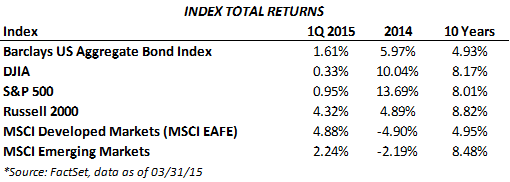

The US stock market recorded small gains in the 1st quarter with the S&P 500 up almost 1%, reaching all-time highs midway through the quarter before giving back some of those gains. Amid the choppy US market trading, international developed and emerging markets outperformed the S&P 500 during the quarter with gains of 4.9% for the MSCI EAFE developed markets index and 2.2% for the MSCI Emerging Markets index.

Market volatility spiked in December and January but has calmed the last 3 months. Declining energy prices contributed to a sharp US stock market selloff early in the quarter before a rebound in energy prices and news of a 4-month extension of Greece’s debt relief package gave stocks a lift in February. After reaching all-time highs in late February, the S&P 500 stalled in March amid economic data suggesting a slowdown in manufacturing, declining business spending, less than impressive retail sales and weak housing sector data—although these data points were largely dismissed due to the impact of the brutal weather in the east and expected rebound in the second quarter—just like last year.

A growing concern regarding the US stock market this quarter and going forward has been the continued strengthening of the US dollar. The US Dollar Index, a measurement of how the dollar is faring against other major world currencies, reached 100 in March, a level not seen since 2003. The strong dollar will hurt the earnings of large US companies in the S&P 500, as they generate over one-third of their revenues from overseas, which when translated into now stronger dollars results in lower actual revenue. Small cap companies in the Russell 2000 get about one-fifth of their earnings from overseas, which has helped small cap companies less impacted by currency effects to outperform their large cap counterparts in the first quarter. We have noticed many companies citing the strengthening dollar as a headwind during 1st quarter earnings conference calls, and between that and the lower energy prices, Wall Street analysts have been dramatically reducing first quarter earnings expectations throughout the quarter. So much so that on a year-over-year basis the expectation is for negative earnings growth for the first time since 2009.

Sector performance was mixed in the 1st quarter, with the health care (+6.5%) and consumer discretionary (+4.8%) sectors leading the way amid optimism over the outlook for the US consumer. The utilities sector (-5.2%) was the laggard as investors took profits and perhaps anticipated a rising rate environment on the horizon. There was an interest rate spike in February, as the 10-year Treasury moved from a quarter-low 1.65% to a quarter-high 2.25% in just a few weeks, which negatively impacted utility stocks despite rates tailing lower toward quarter-end. The energy sector (-2.9%) also struggled as oil price movements remained volatile and WTI crude saw a price decline of around 10% during the quarter, a reflection of US production that continues to grow (albeit at a slower rate) and increasing US oil inventories at Cushing, OK. Additionally, reduced capital expenditures by energy companies in response to lower oil prices may also weigh on the profitability of related industrials.

US treasuries marked their fifth consecutive quarter of gains, as the 10-year yield fell from 2.17% to 1.92% for the quarter as rates continue to exhibit heightened volatility. In March, the Fed set the tone about the timing of its first rate increase by removing the word “patient” from its policy statement. However, Fed Chair Janet Yellen later clarified that this does not mean the Fed will be impatient in raising rates. The next Fed Funds rate increase will be data dependent with the employment situation and inflationary trends the key variables to monitor going forward. Typically when one sees unemployment coming down, as it has during this recovery, wage inflation picks up. This is a natural progression, an inverse relationship for the past 30 years. But it has disconnected during the most recent recovery. There are a few causes, corporations continuing to keep costs at a minimum, the Obamacare reason to hire part time workers, and the continued retirement of the baby boomers (replaced with lower wage earners), but what is more important is the impact it has on Fed decision regarding interest rates. As long as inflation, both wage and CPI/PCE, stays muted the Fed is not forced to raise interest rates. The Fed is also concerned about the US dollar strength and that US rates are substantially above rates in other developed countries (German 10-year Bund yields hit a low of 0.07% last week).

International and emerging markets outperformed US markets this quarter, as the European Central Bank began its Quantitative Easing Program. The QE program, which began in March, cued a rally in European equity markets as the total size of the stimulus was larger than expected. The ECB plans to buy €60 billion ($64.8 billion) of Eurozone government, agency, and European institutional bonds per month through at least 2016. Stocks in Europe rallied almost 11% in local currency terms for the quarter, though those returns were less in U.S dollar terms (MSCI EAFE Index return was 10.97% in local currency terms vs. 4.88% in dollar terms). European sovereign bond yields declined even further.

Emerging markets saw strength on the back of the ECB’s quantitative easing announcement and several interest rate cuts across the emerging world. However, there was also evidence of slowing growth in some emerging countries, as China lowered its economic growth target to 7% from a previously announced 7.5%, and Russia and Brazil are expected to fall into a recession later in the year. Despite these obstacles, emerging markets continue to expand at a faster rate than developed countries and still offer compelling growth opportunities for investors.

Despite heightened volatility, the US stock market posted positive returns in the first quarter as low interest rates, strong corporate balance sheets, and record profitability continue to lend support to equities. International economies are stabilizing and are seeing additional support from the ECB’s quantitative easing program. Emerging market equities continue to trade at a discount, which makes their current valuations a compelling investment opportunity. The US treasury market has defied expectations for rising rates yet again, though we expect continued volatility as the possibility of a Fed rate hike increases. The outperformance of international and emerging markets over the S&P 500 this quarter points to the importance of diversification, a strategy that will continue to be important going forward.