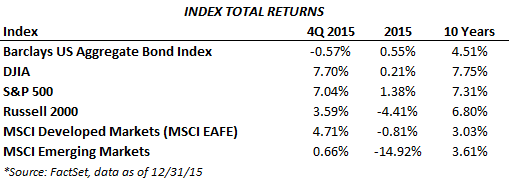

After suffering its worst quarterly decline in four years last quarter, the S&P 500 bounced back with a 7% gain in the fourth quarter to close the year up 1.38% on a total return basis. There were significant disparities in returns across asset classes, highlighted by the 10.5% drop in the Bloomberg Commodity Index. The energy sector again led the decline as WTI crude oil fell 23.4% while natural gas was down 22%. It is in this environment where opportunities can be found but this does not take away from the pain felt by energy investors this quarter and throughout 2015. As 2015 ended, the energy sector remained a dark spot in the investing landscape; rising U.S. supplies and OPEC’s decision in early December not to cut production pushed oil prices to 11-year lows.

As we kicked off the fourth quarter, a worse than expected October jobs report caused investors concern about the economy as jobs disappeared in the oil sector and exporters struggled with the strong dollar. The Fed postponement in September, the disappointing labor report, and continued slowing growth in China was treated as good news by investors hoping for continued monetary stimulus—or at least further delays in rate hikes. However, data released later in the quarter showed the U.S. economic expansion remained largely on track and job growth accelerated again in November with weekly jobless claims near decade lows. Finally, after years of speculation, seven years of zero interest rate policy and a decade since the last rate increase, the Fed raised the target Fed Funds rate by 25 basis points on December 16. This is a sign of confidence in the economy, but we remain in the same boat of not knowing when the Fed will raise rates again. The Fed stated its goal is four additional rate hikes in 2016; however the futures market is pricing in only two or three. We expect volatility to continue as each piece of new economic data released causes investors to position for a quicker rate hike or for more delays.

In the fixed income world, the benchmark U.S. bond index was down slightly in the fourth quarter as investors digested the news that the Fed was likely to hike rates in December. Though the rate hike was widely anticipated, we saw some volatility within fixed income as the yield on the 10-year Treasury note rose from 2.06% at the end of September to close the year at 2.27%. The high yield bond sector, where the energy and materials sectors comprise approximately 20% of the market, came under severe pressure this quarter as lower energy and commodity prices weighed heavily. Municipal bonds outperformed other fixed income sectors for the quarter and the year as strong demand and limited new supply drove returns.

U.S. GDP growth was sluggish in 2015, slightly above a 2% annual rate. The growth was attributed to the strength of the U.S. consumer and an improving housing market. Headwinds to growth were in the manufacturing sector due to exposure to the decline in the energy complex. Additionally, the relative strength of the U.S. dollar weakened net exports and large multinational companies’ profit margins due to accounting translations of revenues earned in foreign currency. As a whole, the U.S. economic picture was at least bright enough for the Fed to raise rates, and the economy displays little compelling evidence of a recession on the near-term horizon.

Globally, the consistent themes abroad are sluggish growth, weak currencies relative to the dollar, and accommodative monetary policies. Developed markets outside the US gained 4.71% for the quarter but were down slightly for the year. In Europe, lower energy prices, a weak Euro, and relatively strong private consumption may provide a tailwind to economic growth, especially when combined with continued monetary stimulus. In Japan, GDP growth turned positive in the second half of the year but deflation remains a concern with core inflation under 1%. The massive stimulus of Abenomics has yet to deliver the desired results in full. Attractive valuations in both Japan and Europe relative to the U.S. offer compelling investment opportunities.

The divergences in monetary policies between the U.S. and other countries caused continued strength in the U.S. dollar. Global deflationary concerns, originating from the slowdown in China, has put further stress on energy and other commodity prices and further slowed emerging market growth. Emerging market equities significantly underperformed the developed world in 2015, down almost 15%, although they were flat in the fourth quarter.

Much of what transpired the last year is still an issue going forward. China is definitely slowing; it may even be in recession. While we expect that issue to continue this year, it will not last forever—it is part of an economic cycle all economically developed countries go through—it is just rockier given the transition from emerging to developed. The price of oil continues to be volatile; the decisions of OPEC, China and Russia, the weather, and the inherent geopolitical instability in the Middle East will play a factor in the stabilization (or not) of energy prices. The Fed’s plan for the next rate hike will keep investors guessing. The first hike was a vote of confidence in the economy, but rates today are still near historic lows; they were not even this low during The Great Depression! The Fed is still massively accommodative and the market expects that to continue. And of course, it is an election year.

These uncertain times present investment opportunities, and volatility can be good when it goes in the right direction. We continue to maintain diversified portfolios for our clients. Over the long-term this is the most prudent direction to follow, and will add value over time as we are able to buy the sectors that struggle the most. We share the frustration of watching certain sectors underperform for extended periods of time, but that is often when it makes sense to add to the positions.