Introduction

At the time of this letter, it does not make that much sense to review the past quarter. Much of the quarter was just a prelude to the two major events of the last month—the Fed announcement in mid-September, and the actions of Congress the first two weeks of October. Those two events received so much media attention I will not burden my loyal readers with a review. I will look at the ramifications of them and then move into more interesting topics. Specifically the views of some leading investors, economists, and political pundits obtained in two conferences we attended recently.

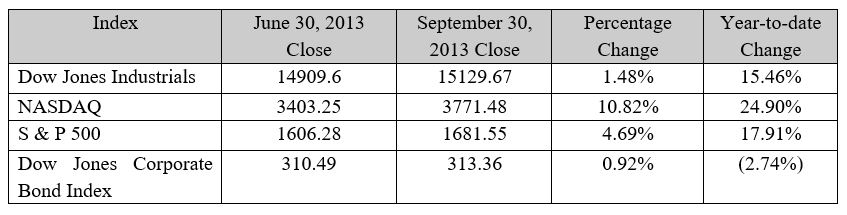

The Markets

Shall we start with the Fed? Despite having the markets completely prepared for a small reduction in the Quantative Easing (QE) program at the September meeting, the Fed decided to take no action. Both stocks and bonds have soared since then, with the US stock indices setting record highs. This action of the Fed seems, at best, questionable, and, at worst, outright irresponsible. We can debate whether the original drastic measures taken around the time of the Lehman bankruptcy were warranted—some would say they were, that by doing so the Fed prevented The Great Depression II; others would say the Fed prevented the natural destructive forces of capitalism from getting rid of the bad parts of the economy (like a forest fire—while painful in the short term, it sets the table for many years of new growth).

However, we will save that discussion for another time as the currently significant question is ‘How can the Fed still think this drastic measure of 0% interest rates plus buying $85 billion of treasuries and mortgages every month is still deserved?’ The economy is obviously not that bad anymore. Even if you believe it will slow down if some of the stimulus is removed, that is probably not a bad thing as we are due for a cyclical slowdown anyway, and the QE buying could always be increased again if things really got that bad. The longer term issue is that the Fed may be creating an economy so dependent on ultra-low rates that there is no way we can get back to a normal interest rate environment without experiencing the dramatic, painful slowdown the Fed sought to prevent in the first place. What I mean is that it is possible that the Fed has now created an economy in which neutral Fed policy is 0% Fed Funds rate. That is, once the taper is complete (if it’s ever complete) the Fed will have great difficulty raising rates at all. With Janet Yellen almost certain to be the next Fed Chair that prospect is not such a ridiculous idea.

I think one clear consensus comment from the conferences was that the policies of the Fed—the European Central Bank, the Bank of Japan, the Bank of England, etc. are also guilty—have skewed the economy to such a degree that logical investors actually have no idea what assets are worth anymore. The Fed has never tried to manipulate the economy in this way, meaning attempting to change the value of assets and the value of money to this degree; therefore, trying to value a company, a stock, or even a bond is actually not possible in the current environment.

The various speakers seemed to disagree about the next action of the Fed. Most thought a taper would occur soon, but not necessarily as soon as the market thinks. However, it was a split decision on the pace of the taper: some thought it would be faster than the market is expecting, once it starts; others thought it would take about a year; some thought it would start, and then quickly be reversed; and finally one economist thought the Fed would actually do QE forever and even start buying equities (like the Bank of Japan) if things got bad enough. That is quite a dispersion of opinion!

The Fed did not take action in October; the uncertainty created by the government shutdown took care of that risk. A December taper is possible, but unlikely. Therefore, the first taper is likely to be in January, although it is possible it could stretch to March. The biggest unknown right now is that Congress pushed the budget/debt ceiling debate to January and February respectively. It is entirely possible that we will go through this whole thing again and that the uncertainty, and volatility that goes with it, will allow the Fed to pause all the way till that March timeframe.

The Shutdown and The Debt Ceiling

So that makes a nice segue to the actions, or lack thereof, of Congress. When discussing the shutdown Leon Cooperman noted, “The circus is closed but the clowns are still being paid.” When discussing taxes, Marc Faber stated that Congress “is a bunch of thieves bickering over how the loot is divided.” So I think you can see the general view of Congress expressed by the speakers.

As you know, the budget discussion was put off till January, and the debt ceiling till February. Something that I find interesting, which is not getting much media attention, is that the debt ceiling actually was not extended, meaning there was no agreement on a new debt ceiling level. The discussion was simply tabled until a February 7, 2014 date. What that means is that at the present time, there is no debt ceiling; the government is free to issue as much debt as possible until February. I think the bottom line issue is what will have changed in three months. If Congress is going to return to these items in the New Year with the same bipartisan bickering they just displayed, then we are in for more of the same volatility, uncertainty and negative economic impact.

The Political Scene

One speaker that was especially insightful was Gregory Valliere, the Chief Political Strategist for Potomac Research Group. Jim and I thought you would enjoy a summary of his comments. This section is a recap of his views on the current situation in D.C. as well as the prospects for the coming elections. Mr. Valliere is bullish on the markets because of two reasons; one, a dovish Fed, and two, a declining budget deficit.

He believes the Fed is dovish because he thinks that Ms. Yellen is unlikely to raise rates for a couple years. Since inflation is under control she may want to see unemployment at or below 6.5% (the previously stated Bernanke Fed target for rate increases) for a while before moving rates. As for the taper, he expects it to start in January and take a full year to be completely removed.

The budget deficit was $1.1 trillion in FY2012; it was $700 billion in FY2013. That is a massive reduction; admittedly it is from a record level, but it is clearly a significant development. While that $700b figure is still alarmingly high, the average deficit since WWII ended is 3% of GDP. $700b is about 4.7% of the current GDP; high, but not by that much. Furthermore, Mr. Valliere thinks the budget deficit will continue to decrease and that we will be near a surplus by 2016 due to a continuation of the policies of the past year, specifically, better than expected receipts, no new spending, and actual spending cuts. The additional receipts may be tougher to continue on the current pace as some of that was due to accelerated capital gains taken at the end of the 2012 calendar year (which is the early part of the fiscal year 2013). However, so long as the House is controlled by the Republicans there will be no new spending by the government. Additionally, usually when Congress debates spending cuts they are talking about a decrease in the growth rate of future spending. However, the past year has seen an actual reduction in spending, which is likely to continue. Mr. Valliere estimates the GOP will retain their majority in the House in the 2014 elections and may even pick up 2-3 seats in the Senate. So he expects spending to continue to be reduced through the 2016 elections. Chillingly, he stated that the budget deficit balloons after 2016 if Congress is unable to address the entitlement problems.

Mr. Valliere was negative in his assessment of President Obama, not out of any partisan reasons, just simply that is the way he sees the situation. In his view, the President is already a lame duck with 3.5 years to go. This is based on two things; one the handling of the Syria conflict was amateurish—the US public clearly has no stomach for military involvement in the Middle East (and maybe anywhere) and this has left the US isolationist. This means the biggest risk to the world is an Israeli/Iranian conflict, especially if the US will not become involved. Therefore, Russian President Putin is now the most powerful leader in the world. The second reason is that even the Democrats recognize that the President has little political skill as evidenced by his inability to get anything passed.

Which brings us to the 2016 elections—Mr. Valliere stated that Hillary Clinton is not only seen as a lock to win the Democratic nomination, but is clearly the favorite to win the presidency as well. However, there is one problem with anointing her just yet; the US public likes to see a change every eight years. Ms. Clinton cannot present herself as different enough from Mr. Obama to garner that attention, nor can Vice President Biden. This means the dark horse candidate is Elizabeth Warren (please do not tear up this letter; I am simply passing on the opinions of the speaker). All kidding aside, I think Mr. Valliere is hinting that the early favorite is frequently not the eventual winner of the nomination. On the GOP side, he said if the nominations were given out today that Rep. Paul Ryan would win, but he would only win 10 states. Mr. Valliere thinks that Chris Christie, the New Jersey governor, is the only GOP candidate who has a shot at beating Ms. Clinton; but the bigger question perhaps is can he win the nomination.

The Future

For the short term the mantra “don’t fight the Fed” continues to ring true; while the stock market looks fairly valued, it is certainly possible we will go a while before valuations get stretched. Additionally, given the magnitude of the downturn, it stands to reason the recovery will be longer than average, despite the snail’s pace we have seen thus far. The intermediate term is murkier as eventually (I hope) the Fed will begin to taper and eventually the economy will be left to operate on its own. I have no doubt there will be some pain involved with that and we may see a good sized correction, but I think many corporations are in good shape and once freed of the artificial stimulus and Congressional ineptitude could continue growing at a steady, albeit reserved, pace. In the long term, I have serious concerns about rates rising. It has less to do with inflationary pressures and more to do with the Fed losing the bond market. Another way of saying that is what happens if there is an auction and no one shows up? At some point I fear investors, especially foreign investors, are going to demand higher rates due to the inherent risk of owning treasuries. There is nothing the Fed can do about that, except maybe actually reversing course, and acting more rationally and less stimulative, but that has to be done ahead of time.

Conclusion

Perhaps the entire problem is the Fed and Congress are working in conjunction to massage the economic recovery but in reality they are retarding the progress. Marc Faber said something along those lines when he discussed how the Fed fattens the pigs with asset inflation and Congress slaughters them with higher taxes. Nevertheless, despite the drama in Washington, stocks have continued to rise to new record levels. Ed Finn, the editor of Barron’s, possesses a bullish outlook largely because of discussions with various CEOs in which they state their companies are in good shape, have lots of cash on the balance sheet, and are waiting for the government to make some decisions. At this point they will know the environment in which they are operating and can make decisions on how to spend their capital. I have said many times that the markets, and in this case the economy, do not hate change, they hate uncertainty. For better or for worse, once we know how ObamaCare will be implemented, the budget numbers, and the new debt ceiling, companies can make decisions on what to do. However, they can do nothing when every measure passed by the House tries to change something that has not even been implemented yet.

For the time being we continue to like stocks as the best investment vehicle, continue to shorten duration by taking some interest rate hedges, and continue to like higher yielding positions that give us some insulation and income while we wait for all of these unknowns to work themselves out.