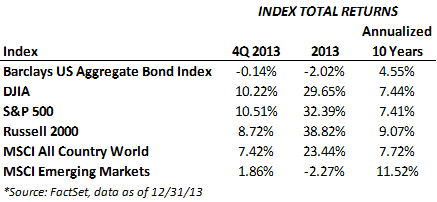

After beginning the year with strong relative performance of interest-rate sensitive and defensive equities, the second half of the year was led by economically sensitive sectors, such as consumer discretionary, industrials, and financials, which began to outperform when Fed Chairman Ben Bernanke signaled a sooner than anticipated QE3 tapering against the backdrop of stronger economic data. The sectors that lagged in performance were materials, energy, utilities and telecommunication, which struggled with lower commodity prices, overcapacity, and rising interest rates. For the 4th quarter, the S&P 500 was up 10.51% to bring the 12-month return to 32.39%, the best annual return since 1997.

Fourth quarter performance was aided by the bipartisan federal budget deal struck in December that was a welcome relief from prior political gridlock. Additionally, the QE3 tapering announcement was met with somewhat surprising optimism from the market, as it was viewed as a sign of confidence in the US economic outlook rather than the beginning of a difficult period of monetary tightening. The taper was announced in December 2013 with a modest reduction in purchases by the Fed from $85 billion per month to $75 billion; the next step was announced at the January meeting just a few days ago to $65 billion. It is anticipated that the Fed will continue to reduce purchases through 2014, though the nature of the taper will be data-dependent. This is unlikely to change now that Janet Yellen Is the Fed Chair, as her policies are expected to be an extension, and perhaps even more dovish than Mr. Bernanke’s policies.

The US economy experienced a slight acceleration in 2013, as estimated GDP growth averaged 2.3% despite a drag from higher payroll taxes and a slowdown in government spending due to sequestration cuts, versus just 2% GDP growth the prior two calendar years. However, the growth in the second half of 2014 was the best six-month period in many years. Some other positive economic indicators included strong housing market data, improved corporate balance sheets, increased consumer spending, stronger auto sales, job market gains reflected in employment data, lower inflation, and a revival in manufacturing.

In Europe, the ECB cut its main interest rate to a record low of 0.25% in November in an effort to stimulate a recovery that has been quite bumpy since the recession of 2009. The ECB indicated in December that the Eurozone is expected to shrink by 0.4% for the full year of 2013, and said that it was expected to grow by a modest 1.1% in 2014. In Japan, the policy of Abenomics took hold and sparked a dramatic weakening in the yen and a boost to Japanese exports and the stock market. In the developing world, the performance of emerging market equities improved in the 4th quarter, although it remained a drag on performance, as concerns over the impact of Fed stimulus reduction, the weakening yen and disappointing economic data from developing economies kept a lid on investor risk appetite in this sector. Despite recent disappointing performance, there are compelling valuations in emerging markets, as equities are trading at a discount to their historical valuations and a significant discount to their peers in the developed markets.

US stocks outperformed global equities over the past 3 years, as the US emerged more quickly from the global financial crisis than international developed and emerging markets. This was a year when asset allocation/diversification worked against investors. The difference between the performance of a 100% U.S. stock portfolio and a typical 60/40 stock and bond portfolio was significant, as evidenced by the 13% return of a 60% MSCI AC World Index and 40% Barclays Aggregate Bond Index portfolio versus the 32.39% return of the S&P 500. The yield on the 10-year treasury rose 1.26% in 2013 and the Barclays Aggregate Bond Index fell over 2%, the first annual loss in the index since 1999. This has prompted some investors to question the role of bonds in a portfolio. Municipal bonds experienced significant difficulties with downgrades of Puerto Rico, a bankruptcy filing in Detroit, and other cities like Chicago experiencing concerns over their budgets. Rising rates may hurt municipals more, as they typically have lower coupon payments and longer maturities than taxable bonds, though yields on municipals are now quite attractive.

The S&P 500 began each of the past 3 years with a forward P/E multiple of around 13x. With the S&P 500 closing 2013 at 1848, the current forward multiple is 16x on 2014 consensus earnings estimates. Non-US developed markets are a couple points below that and emerging markets sell around 10 times earnings, which are reasonable levels as long as the earnings estimates at least fall in line with 2014 estimates. Some global macroeconomic risks (e.g., instability in the Euro zone and the Iran/Israeli nuclear disagreement) have moved to the background, the Fed is expected to keep rates low, credit conditions have begun to normalize, Congressional budget fights are behind us for now, and the US employment picture has improved (albeit with some help from the declining labor participation rate). These factors have provided a tailwind for equities but there certainly remain some concerns, such as the possibility of rapidly rising interest rates amid the Fed taper, corporate earnings coming in below expectations, and continued struggles in developing economies.

We believe that the benefits of diversification will return in 2014 and beyond, and remain committed to employing an investment strategy that maintains exposure to various assets across different sectors of the economy and world, as we anticipate that 2014 may see an increase in volatility following the consistently strong performance we witnessed in 2013. Please contact us to discuss any or all of these points in this letter in greater detail.