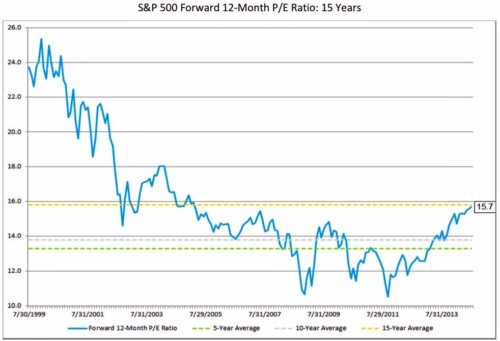

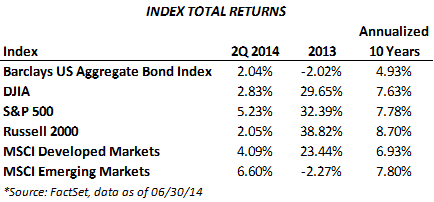

The S&P 500 and the NASDAQ both recorded their sixth consecutive quarterly gain in the second quarter, a streak not seen for over 14 years; this despite the fact that many investors have expected the six-year long bull market for stocks to end. Stocks continue to set record highs, yet the S&P 500 only can be considered fairly valued today with a forward P/E of 15.6 as of June 30, 2014 (the 25-year average is 15.5). Corporate management remains conservative with about 30% of the S&P 500’s corporate assets in cash. In the early stages of the market rally, we saw companies increasing stock dividends and buybacks, while today we are seeing a significant increase in merger and acquisition activity. As earnings season kicks off, it will be important to see earnings growth based on top-line revenue growth not just cost savings.

Speaking of corporate cost savings, part of the problem with the slow job creation in this recovery is that companies are so much more efficient than in the past. Google has a market cap 50% bigger than GE but employs 46,000 people vs 305,000 for GE. Blockbuster at its peak employed 60,000 people, the “new” blockbuster, NFLX, employs 2,000 (Kopin Tan, Barron’s 2/3/14).

*Source: FactSet, data as of 06/30/14

Among S&P 500 sectors, energy (+12.1%) was the strongest sector due in large part to commodity price strength and the domestic energy renaissance. US production of oil and liquids in 2012 was 11.1m bbl/d, roughly the same as 1985, by 2016 it should pass the peak level hit in 1970 (Thomas Donlan, Barron’s 1/20/14). Utilities (+7.8%) delivered impressive results amid declining interest rates and the continued search for yield by investors. Technology (+6.5%) also posted solid returns as we saw strong demand forecasts from semiconductor manufacturers and software developers. Most other sectors also performed well, with consumer discretionary (+3.5%) and financials (+2.3%) lagging but still positive. Lower long-term rates weighed on earnings power expectations for banks, while a number of apparel and specialty retailers fell sharply on disappointing earnings reports and lower than expected retail sales numbers.

Globally, both developed and emerging markets had strong gains this quarter amid ongoing accommodative policy from central banks. Eurozone equities were supported by expectations that the ECB would continue to ease monetary policy and possibly start their own version of quantitative easing. In early June the ECB announced a range of measures to combat the prospect of deflation, including cutting the benchmark rate from 0.25% to 0.15%, introducing cheap 4-year loans to increase lending to small businesses, and introducing a negative deposit rate—a first for developed economies. Emerging markets stocks outperformed the S&P 500 and the MSCI World Index this quarter. Emerging Asia was strongest led by outperformance in India on improved growth and reform prospects following the decisive electoral victory of Narendra Moji. Latin American markets also performed well this quarter, while laggards were found in the Middle East and Greece.

Intermediate and longer-term treasuries rallied during the quarter, as the 10-year treasury yield fell from 2.73% at the end of Q1 to 2.53% at the end of Q2. The rally in U.S. government debt helped most fixed income sectors generate strong returns during the quarter. Treasury yields fell for a multitude of reasons: the biggest may be less supply, as the US Government runs a smaller budget deficit there are fewer bonds that need to be issued; second, yields on US Treasuries are higher than comparable yields in Japan and Germany (recently at a record low of 1.26% on the 10yr bund) and just slightly lower than nations such as Spain (2.7%), Italy (2.8%), and the UK (2.7%); and third, rumblings that the Central Bank of China is buying treasuries in an effort to weaken the yuan.

Despite the concern that easy monetary policy throughout the developed world would lead to high inflation, inflation rates have remained subdued in the U.S. and globally, supporting the likelihood that the Fed will continue to slowly remove the existing stimuli. The Fed recently revised its GDP growth projections downward from 2.8% – 3.2% to 2.1% – 2.3% in 2014, and the projected unemployment rate was also revised negatively from 6.0% – 6.1% to 6.1% – 6.3%. In notes released from the most recent Fed meeting, 75% of FOMC participants anticipate the first increase in the fed funds rate to occur in 2015. The median expected rate level is currently 1.125% for year-end 2015 and 2.5% for 2016. However, the Fed is not giving folks a lot of confidence when they keep moving the targets. Whatever happened to the statement that when unemployment reached 6.5% it would be time to raise rates? It was changed to “well past the time that unemployment falls below 6.5%.”

Much of the economic data in the second quarter of 2014 saw an improvement from the weather-impacted first quarter data. Manufacturing and non-manufacturing activity increased during the period, pointing toward strengthening economic activity, and housing market data showed signs of continued recovery. Employment data was positive, as job additions continued to improve with 288,000 jobs added in June—the fourth month in a row over 200k, the first time since January 2000 that has happened. The unemployment rate fell from 6.7% in March to 6.1% at the end of the Q2. On the negative side, retail sales data came in below consensus, suggesting that a rebound in consumption growth might be lower than initially expected in the second quarter.

If the onslaught of shareholder-friendly policies is indeed cooling (buybacks and dividend increases), investors will need to find a new catalyst to drive stock prices higher. There aren’t many obvious drivers right now. Earnings growth remains lukewarm, the economy started the year much slower than anticipated, stocks are arguably fairly valued, perhaps overvalued, profit margins are at record highs and geopolitical concerns in Ukraine, Russia, Iraq and Gaza continue to weigh on the market. Yet the market continues to rise and there is precedent it could continue—when the S&P 500 rises less than 4% through May (3.9% this year) the rest of the year is positive 78% of the time (Steven Russolillo, WSJ Morning MoneyBeat 5/30/14). After all, would any of the pundits with year-end targets on the S&P 500 of 1950-2000 have put those numbers in place if they knew the first quarter GDP growth would be -2.9%, a level absolutely no one predicted? Doubtful, yet as of the time of this writing many of the year-end predictions have already been surpassed.

It is important to remain diversified in this environment. It is easy to look at the volatility measures and think one should load up on stocks. The VIX, the most commonly cited measure, has only closed below 12 five times in the past 10 years before May 2014. Since May 21st it has happened 21 times through June 30, including many below 11. A number of those closes were the lowest since February 2007. And the S&P 500 just recently ended a streak of 61 days in a row without a 1% move in either direction, the longest since 95 days in 1995.

We are due for a correction, but that does not mean it cannot begin from a significantly higher level, so it is imperative investors stay diversified with prudent allocations to bonds, alternative investments and appropriate hedges while not becoming nervous and going to cash. This is our plan going forward.