Oil took center stage amid the staggering 40%-plus decline in the price of crude during the quarter. More than half of the losses in crude came after the Thanksgiving OPEC meeting where its members, led by Saudi Arabia, voted against reducing crude production. Crude prices plummeted and closed the year on the lows, unable to find support. Most experts over the past few years have pegged the fair value of oil around $90-$100 and many saw this increasing due to growing demand from emerging markets and decreasing supplies. However, the shale revolution in America, slowing growth in China and Europe, better technology for alternatives, and OPEC’s decision have combined to let market forces dictate the price, as some of the higher-cost producers get shaken out.

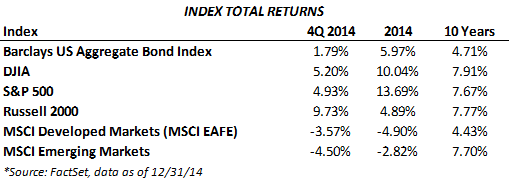

The 4th quarter of 2014 saw the return of market volatility. The S&P 500 fell just shy of 10% in October and then rallied shaking off another 5% decline in December to close the quarter up over 4%. For the year, the S&P 500 saw a gain of 11.4% as US equities continued to outperform on a global basis. However, 2014 was also a year of dispersion in US equity market returns. The Russell 2000 Small Cap Index gained only 4.9% on the year, while the S&P 500 Energy Index was down 7.8% for 2014 after declining 10.7% in Q4. To further highlight the dispersion in returns, the S&P Oil & Gas Exploration & Production ETF (ticker XOP) was down 29.4% on the year and fell over 30% in Q4. However, the US stock market proved resilient even as the energy sector collapsed under the weight of declining crude prices, and even as the IMF and OECD warned of risks to the global economy in early Q4. Much of the debate, globally, on what to expect for 2015 revolves around whether the consumption increase from lower oil prices will outweigh the loss of energy company capital spending. In the US, the revision of 3rd quarter GDP higher to 5% in December seems to suggest that the US economy is on solid ground as consumer and business spending came in stronger than previously assumed. Nevertheless, the earnings reports for the 4th quarter have only just started so it remains to be seen how severe the energy spending cuts will be and how much the retailers are seeing of those gas savings.

From a sector standpoint, utilities led the way in the 4th quarter as the traditionally defensive sector saw strong gains (+13%) amid declining yields and rising market volatility. The consumer discretionary (+8.7%) and consumer staples (+8.2%) sectors also saw strong gains as good Black Friday sales and cost savings from lower oil prices drove expectations that consumer spending is strengthening. The energy sector (-10.7%) was the primary drag on the S&P 500 due to the negative impact of energy prices on future oil company earnings.

Meanwhile, treasury yields continued their march downward despite the consensus view that yields would start to rise in 2014 as the Fed completed its exit from quantitative easing (QE). The 10-year treasury yield closed the year at 2.17%, down from 2.49% at the start of the quarter and 3% at the beginning of 2014. Within fixed income, high yield bonds were the exception as the drop in oil caused prices created concerns about the debt of smaller oil companies. It is very interesting that yields on 10-year treasuries are still some of the highest yields among developed countries, so long as European investors fear deflation in the EU (more likely to happen than in the US currently), this condition is likely to be sustained. Economic data continued to be strong in the US—Q3 GDP growth was strong; the unemployment rate has dropped to 5.8%, down from over 10% just five years ago; inflation, the Fed target is 2%, remains low with core CPI around 1.61% for December and continued disinflationary pressures from declining commodity prices; and much of the movement in treasuries has been determined by actions of central banks in recent years. The combination of a strong, stable economy, low inflation, low interest rates, falling gasoline prices, and falling unemployment levels have resulted in soaring consumer confidence.

International stock market performance disappointed this quarter. The MSCI Developed Markets Index was down 3.6% and the MSCI Emerging Markets Index declined 4.5%. Weakness existed in GDP growth and manufacturing, as well as high unemployment and threats of deflation in the Eurozone. GDP growth in the Eurozone was just 0.1% in Q3 and inflation was anemic at only 0.3% in November. The ECB has increased its accommodative stance by recently implementing a QE program similar to the US in an effort of attract foreign capital and stimulate economic growth similar to what the Fed policies have done for the US.

Further east, the Japanese stock market gained 6.2% in yen terms despite the country seeing weaker than expected economic data. Japan’s inflation rate fell to its lowest level in over a year in November at 0.7%, pressured in part by weakness in the price of oil which will ultimately provide a boost to the oil importer’s economy. Despite Prime Minister Abe’s continued accommodative economic policies, the world’s third-largest economy contracted 1.9% in the third quarter amid declining capital spending and weak private consumption, which has been impacted by the national sales tax increase in April of this year. In November, another increase in the consumption tax was delayed for at least 18 months.

Finally, the emerging markets (EM) struggled overall, with emerging Asia the best performing region and emerging Middle East and Africa the worst performing. Latin American emerging markets all finished in negative territory in the 4th quarter. The sharp decline in oil prices had varying impacts, as nations such as China benefit from lower prices due to being a net importer of oil but others such as Russia and Brazil were pressured due to their dependence on revenues from energy exports. Russia’s struggles were highlighted by the central bank’s decision in December to hike rates to an astounding 17% and renewed currency intervention, in a move to support the ruble which declined 34.8% relative to the dollar during the quarter. Weakness in Europe was an additional headwind, as many EM goods are imported into the Eurozone. Despite remaining risks, such as increased currency volatility, prolonged commodity price uncertainty and increased geopolitical destabilization, emerging markets continue to provide investment opportunities, as economic growth is much stronger and debt levels lower than the developed world, and stock market valuations are relatively low.

The 4th quarter was defined by the sharp drop in the price of oil and a spike in market volatility. Consensus opinion was generally proven wrong in 2014, as very few people expected interest rates to continue falling or oil prices to be cut almost in half. The S&P 500 continued its march higher in the face of Fed tapering, plummeting oil prices, Ebola scares, the Ukrainian invasion, heightened geopolitical tension, and a host of other newsworthy events. The US stock market was driven by companies posting record margins on the back of minimal wage growth and extremely low interest rates.

2015 is going to be dominated by two things (and the unforeseeable events that occur of course): whether the drop in energy prices is good or bad for the economy and whether the Fed is going to raise interest rates. It is easy to assume “good and yes” but it is not that simple. There is a prevalent theory that the reasoning behind the OPEC decision has been to turn the screws on Russia and Iran, rather than the US shale producers—that theory extends to the US turning a blind eye for much the same reason. If this is part of the situation, geopolitical that is, then oil may remain low enough where the drop in energy spending pulls GDP growth down more than the extra consumer spending pulls it up. It is not just exploration companies that feel the hit, but also alternative energy companies, suppliers of airplane parts (the need to upgrade to more fuel efficient, new models is decreased), office space managers (e.g. in Denver 20% of all office space is rented to energy companies), banks that give mortgages to employees of energy companies, and many other types of industry that have negative exposure. Plus the strongest source of growth in employment, while relatively small, just turned 180 degrees and is now one of the weakest.

As for interest rates, so long as inflation is below 2%, wage growth remains low, the EU continues to struggle, China’s growth remains low (recent numbers are the lowest since 1990), and oil prices remain low or worsen, then the Fed does not have to raise rates. The 2015 economy may see some tailwinds from falling energy costs, low inflation and a rebounding consumer, but margin pressures may be seen from wages that are beginning to rise and a strengthening dollar. There is little room for rising earnings multiples in the stock market so companies are going to have to show top line revenue growth in order to continue growing corporate profits. While we are optimistic that the U.S economy is on pace for continued growth in 2015 and remains the strongest economy in the developed world, we also believe that investment opportunities continue to be found internationally and portfolio diversification remains critically important, especially in this volatile market environment.