I was in New York City recently to attend an investing conference. One of the speakers did not focus on investing but instead the Washington DC political picture. The speaker was Greg Valliere, whom I have had the pleasure of hearing before. I find his outlook on the political scene to be quite good. I thought that since many of our clients keep a close eye on the election process I would share his opinions with you before jumping into the regular quarterly material.

The overriding tenant of the speech is that Mr. Valliere is seeing things this election cycle that he has never seen in his career, which spans something like 40 years. He has never seen so many folks cheering for a rate increase. Mr. Valliere is a fan of the Fed but he sees the current communication as a low point. He does think a December rate hike is still possible. Mr. Valliere stated this is a very unusual Congress, as Nancy Pelosi is the prime power player. The GOP cannot get anything done because they do not have the votes and have to go through Pelosi to get them. John Boehner knew this; and now that Paul Ryan is the new Speaker, he will have to be very careful of how the Right views his dealings with Pelosi.

Mr. Valliere has never seen a situation where both political parties were so apprehensive about their respective frontrunning candidates. Taking the Democrats first, Hillary Clinton is clearly the frontrunner, especially now that Joe Biden has announced he will not seek the nomination. However, the party is concerned about what the next revelation will be—i.e. the chapter of the email scandal, or if there is something else lurking. The party is also concerned that in the polls Mrs. Clinton has a higher Negative rating than a Positive one. Additionally, the polls say the majority of voters do not trust her.

The GOP frontrunner is Donald Trump currently. Mr. Valliere explains a nomination election as taking place in two Acts. Act 1 he calls the Primal Scream Phase; basically a venting stage where the outsiders tend to do well. However, in Act 2, which starts at the first Caucus in Iowa, usually in early February, the voters begin to assess the worthiness of the candidates. They begin to judge them on their personality and leadership abilities; and whether they really want to give a certain person access to the Big Red Button—the nuclear arsenal. Mr. Valliere’s opinion is that Mr. Trump will not do well in this regard, and in fact, thinks Mr. Trump may not make it till Christmas if his numbers fall into the mid teens by then. Therefore, he thinks there is zero probability of Mr. Trump running on a third-party ticket.

Mr. Valliere would rank the GOP candidates in the following, reverse order. He only provided the top five as he thinks everyone outside this list does not have a chance:

- Chris Christie—he is a longshot but he cannot be ruled out

- Ted Cruz—he would be the biggest beneficiary if Mr. Trump fades or exits—he has not said anything negative about Mr. Trump—but he may be running more for 2020

- John Kasich—the Democrats like him, which may be a problem

- Jeb Bush—he has to show some fire in the belly, but he’s a first rate governor and has plenty of money (although this was before his announcement of staff pay cuts)

- Marco Rubio—he is a great speaker from the right state, a great politician, but is a bit young at 44, although no younger than JFK or President Obama

As far as picking an actual winner, Mr. Valliere stated he needed another year to really make that call. However, he also pointed out that every Democratic nominee for the last 25 years (six elections) has received at least 250 electoral votes; only 270 are needed to win.

Mr. Valliere thinks that there will not be any tax reform, outside a small possibility of an international tax bill targeting the repatriotization of overseas profits. The good news is it is unlikely there will be any tax increases given the conservative House. However, the bad news is there will be no corporate or individual tax reform either.

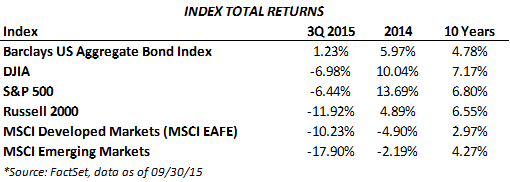

So that is the political scene in a nutshell, and without further ado, we bring you the quarterly review. U.S. equities suffered their worst quarterly decline in four years, as the S&P 500 was down 6.44% in the third quarter (although October is shaping up to be one of the best months since 2011). Investors grew concerned over the economic slowdown in China and emerging markets, and how that impacts global growth. The Fed delayed a much-anticipated rate hike in September, a decision viewed negatively by the markets as Fed chair Janet Yellen cited uncertainty over the global economic outlook in explaining the decision to delay the “lift-off.” The only sector to post gains in the 3rd quarter were utilities while materials and energy, which are closely tied to Chinese demand for commodities, suffered significant declines of around 17%.

Despite concerns of a sharp Chinese slowdown, U.S. markets were buoyed in the first half of the quarter by healthy economic data and better-than-expected corporate earnings growth. However, China surprised investors in mid-August by devaluing its currency, the yuan, relative to the U.S. dollar, raising further concerns about the state of the Chinese economy and leading to competitive devaluations across other emerging market currencies and sharp selloffs in global equities. The MSCI EAFE index of international developed markets declined over 10% in the 3rd quarter, its worst quarterly performance in four years as every country in the index posted losses. It was a similar picture in emerging markets, as the MSCI EM index declined almost 18% and ended the quarter at its lowest level since 2009.

U.S. economic data continued to improve in the third quarter despite the bad news abroad, as the unemployment rate hit 5.1% in August, its lowest level since 2008. GDP grew at an annualized pace of 3.9% in the second quarter, a substantial improvement from the 0.6% growth posted in the 1st quarter. In the fixed income markets, the benchmark U.S. bond index increased 1.23% in the 3rd quarter, as selling pressure on riskier asset classes increased and investors sought the comparative safety of U.S treasuries. The 10-year treasury yield began the third quarter at 2.34%, falling as low as 1.9% amid global uncertainty and dashed rate hike expectations before closing the quarter at 2.06%. The Fed’s decision to hold rates steady at the September meeting underscores the belief that financial market volatility and slowing growth outside the U.S. outweighs the improvement in the domestic economic picture. The earliest the Fed is now expected to raise is at its December meeting, although the anticipated rate hike may be pushed into 2016. While we won’t know until it happens, it is possible that a rate hike would be viewed positively by the markets, as it could send an optimistic message that the U.S. economy is strong enough to function on its own without the unprecedented level of Fed stimulus.

The 3rd quarter was a difficult one across all asset classes, as investors struggled to find a place to hide. While U.S. fixed income offered a safe haven, there was not an equity market that was spared from the uncertainty brought on by China, the Fed inaction and energy price volatility. The energy sector in particular saw severe selling pressure as investors became increasingly concerned about the global demand picture.

The Fed did not do investors any favors in their September meeting. By adding the language about global growth concerns, it created a new level of uncertainty—arguably going so far as to imply there is a third mandate (the first two are widely known to be low unemployment and stable prices). At its October meeting the Fed removed the global uncertainty language and stocks rallied on the positive implication the US economy is not being overly impacted by the global slowdown. While volatility is likely to persist so long as the Fed continues to change the rules of when it will first raise interest rates, the US economy is on pretty solid ground. In fact the global slowdown may be just enough to keep the US recovery from getting out of control to the up side, allowing the Fed to make gradual interest rate increases over the next half dozen quarters or so. A slow, steady rate hike campaign could be very healthy indeed. While we have maintained an exposure to energy during this difficult period, there is an opportunity within the sector that remains attractive to long term, diversified investors.