The 3rd quarter ended on a market downdraft that has continued into October on the back of “the 4 E’s”: Energy, Earnings, Europe and Ebola. Crude oil declined 14.1% in the 3rd quarter and is down 7.5% year to date as of September 30. Oil has been hit by both supply and demand side factors: the slowing global growth means less demand for oil, especially from China; the strengthening dollar also makes oil more expensive for the rest of the world further subtracting from demand. The increased supply from the US also forces the price lower. While the supply side is a longer term issue, the demand side may simply be a cyclical slowdown in China which will eventually reverse.

The month of September was weak for the U.S. markets, as the S&P 500 was down over 1.4%, erasing more than half of the gains of July and August. Part of this can be explained by corporate earnings expectations. According to FactSet, the estimated earnings growth rate at the end of September was 4.7% – almost half of the estimated growth rate of 8.9% reported at the beginning of the quarter. This decline in earnings growth expectations can certainly explain some of the poor performance for the month of September. However, there has been a generally positive tone to earnings reports thus far, which may provide some positive momentum to the stock market in the 4th quarter.

In Europe, the markets were rattled earl in the quarter by the Scottish independence referendum. Though Scotland voted down independence, the mere possibility that it might have seceded from the U.K. forced investors to assess the solidarity and strength of the Eurozone…again. More importantly, the economic news across the pond was mostly weak during the quarter. There is a real risk of a Eurozone recession and deflation. The ECB is exploring starting their own version of QE, but details remain uncertain. Additionally, weak economic growth in Europe has led to anti-euro parties gaining seats in national parliaments and growing political strains. Finally, the Russia/Ukraine crisis carry the potential for disruptions in gas supplies to Europe, as well as economic damage from sanctions, which have further impacted the European economy.

Finally, the Ebola scare caused massive, one-day volatility spikes when the first case was announced in the US, as well as the news that the infected nurse flew on a commercial airplane. This caused a real scare in transportation and tourism related stocks. While Ebola has very negative possibilities for investors, I think the reaction in the first couple weeks of October was overdone. Just like SARS and the Asian bird flu scares, I think Ebola is a temporary phenomenon that will be largely contained.

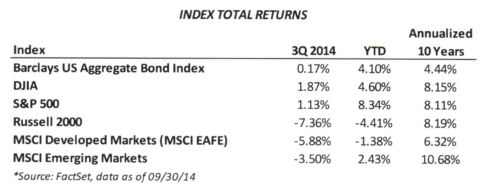

While this letter focuses on the events of the previous quarter, I did not want to overlook the importance of the last few weeks. Without further ado, U.S. markets continued to grind higher in the 3rd quarter, as the S&P 500 recorded a moderate 1.1% increase with the NASDAQ up 1.9%. Interestingly, the Russell 2000 small-cap index was down 7.4% during the quarter as investors have begun to question the lofty valuations of small caps (Russell 2000 forward P/E at 19.9X vs. S&P 500 forward P/E of 14.6X). This divergence bears watching as earnings continued to come in for the 3rd quarter – although a good sign is the outperformance of small caps in the rally since the correction. The story in Europe and the emerging markets was not very positive in the 3rd quarter. There are increased geopolitical concerns as Hong Kong/China, Iraq/Syria and Russia/Ukraine continue to weigh on markets. Additionally, we are looking at a slowdown in China coupled with likely loan defaults and increasing bad debt, while European growth continues to be sluggish as the economy faces its third recession in the last 6 years. Despite the global concerns, the US economy remains strong as the recovery, slowly but steadily, continues and US stocks continue to set records during the quarter.

The path of the U.S. economic expansion remained intact throughout the third quarter. Most notably, the final revision of the 2nd quarter GDP came in at 4.6%, a figure that exceeded economists’ expectations and pointed to the likelihood that a harsh winter may have been largely to blames for the negative GDP reading in the 1st quarter of the year. We note that the last revision was tied to excess spending by corporations (i.e. capital expenditures or capex), which are beginning to use their significant cash balances amassed over the past 5 years. The labor market also saw improvement during the quarter as the unemployment rate dropped to a six year low of 5.90%. New job creation also continued trending in the right direction over the past 3 months as the private sector consistently created over 200,000 jobs on a monthly basis.

The U.S. fixed income market continued to perform well in the 3rd quarter, as the Barclays US Aggregate Bond Index was up 0.17% in the quarter and is up 4.1% in 2014. Despite expectations of an upcoming rate hike next year, we note that the 10-year yield plummeted below 2% in mid-October – the largest daily decline since 2009 – on a series of poor U.S. economic data and perhaps some emotional capitulation by bond market bears unwinding their short bets, and declined modestly from 2.53% at the end of 2Q to 2.49% at the end of the third quarter. Though many have worried that strength in the labor market might cause the Fed to signal an increase in short-term rates, so far policymakers have allayed those fears by signaling no substantial change in their interest forecast to this point. In light of the most recent volatility, investors will anxiously await updated guidance from the Fed at the next FOMC meeting.

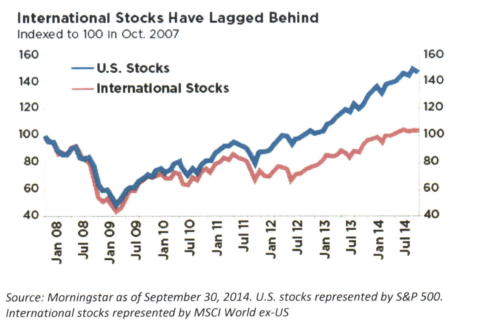

September has historically been a difficult month for the markets, and this was the case again this year, especially in international and emerging markets. However, October has often been the month where the market bottoms, sometimes in dramatic fashion. Stock markets should be expected to adjust to lower growth rates, and companies also need to adjust their earnings expectations based on global economic conditions, especially the strong dollar which may adversely impact the big, US multinationals – although I think that is more a 1Q15 issue. Although market volatility has increased and more global turbulence can be expected, the U.S. remains very well positioned and the economic recovery will likely continue. The question being asked is will the US be able to pull the rest of the world up, or will the rest of the world pull the US down.

Although consumer spending in the U.S. has been muted amid low wage growth, the strong dollar and lower commodity costs may give a boost to domestic consumer spending in the 4th quarter as U.S. consumers benefit from increased purchasing power. Additionally, we thing that international equity investments are currently attractive based on lower valuations, strong dividend yields, and faster expected earnings growth. Finally a word on diversification: at the beginning of the year, and even the beginning of the quarter, the wide consensus was that interest rates had nowhere to go but up; watching the 10yr fall for most of the year, and have a dramatic spike down below 1.9%, illustrates the importance of maintaining a long-term investment discipline. Please contact us to discuss any of these ideas further.