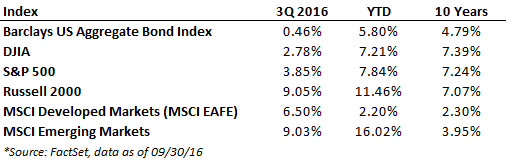

As the second quarter came to a close, the third quarter was shaping up to be a volatile one. However, after enduring the volatility of the Brexit vote right at the end of June, the continued speculation concerning the next Fed action, and the drama surrounding the National Conventions, the market was relatively quiet during the third quarter. While there were a number of potentially major events, in actuality what occurred was a continuation of the status quo. This led to markets around the world performing quite well during the quarter. The major US stock indexes went to new highs and both developed and emerging markets posted strong returns. Despite some volatility in interest rates, fixed income markets posted positive returns as well.

While the S&P 500 posted solid gains, there was significant disparity among sectors. Information technology shares rose almost 13% for the quarter, while higher yielding utilities and telecom sectors, after a strong run of outperformance, experienced declines of almost 6% as concerns over a rate hike and competition from higher bond yields weighed on returns. Corporate earnings showed a further slowdown in profits, though the decline in earnings year-over-year was not as bad as expected due to constantly downward revised estimates. Additionally, while most sectors posted profit gains, further weakness in US exporters and multinationals (due to the strong dollar), and energy companies resulted in declining corporate earnings overall; this continued the trend since mid-2015. Economic data was relatively strong early in the quarter with July and August payroll reports seeming to confirm a healthy labor market. However, the second half of the quarter saw slowing job growth, flattening retail sales, and declining industrial productivity; developments worth watching as we close out 2016. Most of the stock market gains this quarter occurred in July as a result of the post-Brexit rally, and then settled into a narrow trading range the rest of the quarter.

The US treasury 10-year yield reached a record low of 1.37% on July 8, but bounced back to close the quarter at 1.6%. The volatility was the result of global government debt yields hitting new lows following the Brexit vote and continued easy global monetary policy. While many believe the Fed will hike rates another quarter point before year end, Janet Yellen stated after the September meeting that slowing productivity growth had caused Fed officials to lower their long-term growth expectations for the US economy. Although economic data has improved in recent months, it is clear the Fed is taking a cautious approach. Speculation abounds as to when the next rate hike will be, although we are in the camp of a December rate hike once the immediate drama of the election is behind us. Internationally, the Bank of England lowered its benchmark lending rate to its lowest level ever, 0.25%, following the Brexit vote; however, the ECB opted to leave rates unchanged and did not commit to an extension of its bond-buying program at its September policy meeting, surprising many investors who anticipated further easing. With the UK 10-year note around 0.90% at the end of September, and German and Japanese 10-year notes near 0% (a level which the BOJ has pledged to maintain), there are not a lot of monetary tools remaining for central banks in developed markets.

International equity markets posted strong returns in the third quarter, highlighted by emerging market equities providing double digit returns. Following the Brexit vote, the Bank of England increased stimulus measures and lowered interest rates, and investors viewed equities and other risk assets attractively as they searched for yield in the historically low interest rate environment. Although corporate earnings came in better-than-expected across the Eurozone, there was heavy selling among the troubled Eurozone banks. Concerns over the solvency of some Italian banks and the struggles of German banking giant Deutsche Bank amid a US Department of Justice probe into its residential mortgage-backed securities led to underperformance in the Eurozone financial sector. We recognize the Eurozone continues to face significant headwinds—modest growth expectations, high unemployment, elevated debt levels, and ongoing geopolitical stress. However, much of this risk is reflected in equity valuations, and many companies will benefit from the weaker currency, making exports cheaper and translation of dollar based revenue more attractive.

Emerging market stocks were strong in the third quarter under the backdrop of continued accommodative monetary policies that spurred investors’ risk appetite. Chinese and Brazilian stocks posted double digit gains, and China saw policy-driven stabilization despite an economic growth trajectory that has slowed. Emerging markets continued to trade at significant discounts and current valuations remain compelling, although we expect potential volatility and dispersion of returns among emerging market countries. The fact remains that emerging markets have more attractive demographics, rising consumption, and better growth potential than countries in the developed world.

While the existing backdrop has proven favorable for investors this year, it is important to recognize that the global economy continues to face risks. Heightened tensions between the US and Russia continue and may worsen following the election. The Islamic State continues to pose a threat to the West, and the refugee crisis continues to deteriorate. In the US, we have a polarizing election about to conclude and, while economic data remains fairly strong on the surface, we are in an economic expansion that is seven years old. With a bull market almost eight years old (at 91 months currently, the second longest ever), both are showing signs of age amid declining corporate profit margins. That said, financial markets have proven extremely resilient among such challenging circumstances, and the odds of a near-term recession continue to be low. The good part about a mild recovery is there is not a lot of excess in the economy, so it is reasonable to expect, at this stage at least, that the next slowdown could also be relatively mild. As the timing of these things are very difficult to predict, we maintain true to our discipline of remaining diversified in our investment process.